Posted on: September 25, 2024, 02:36h.

Last updated on: September 25, 2024, 03:04h.

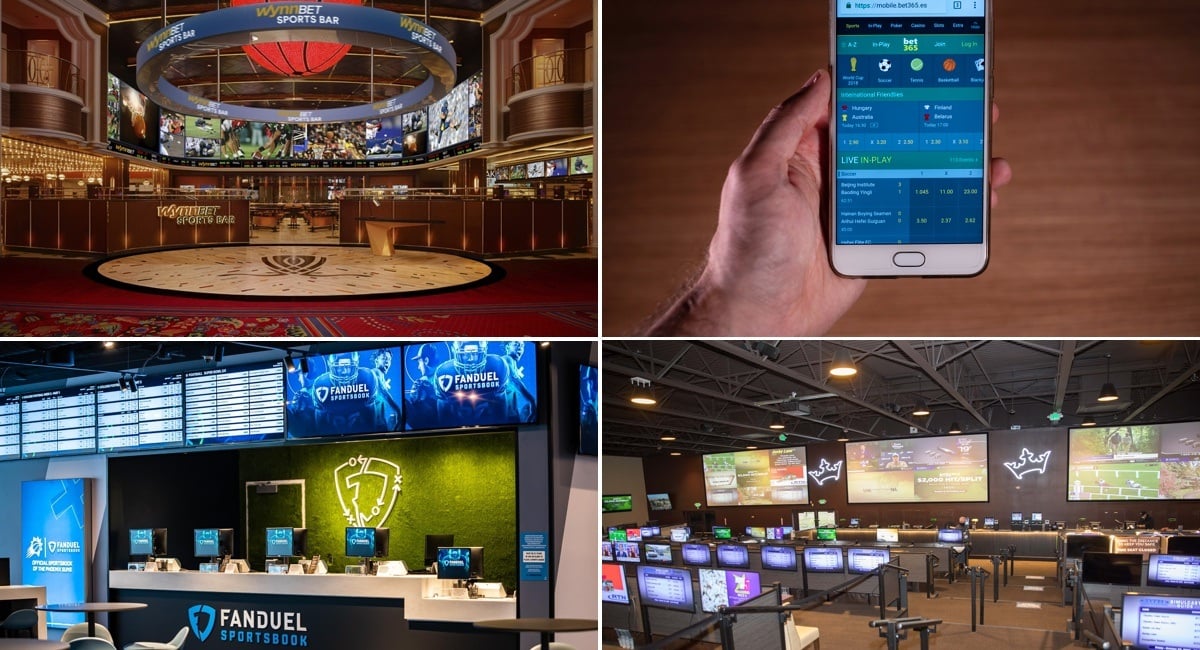

New research from a leading gaming intelligence firm suggests the legal sports betting industry in the United States is only just getting started.

Vixio Regulatory Intelligence, the research division of Washington, DC-based Vixio Gambling Compliance, a regulatory technology company that provides its clients with “independent, authoritative, and actionable regulatory intelligence for compliance, regulatory, strategy, and development,” believes the legal sports gambling industry will grow exponentially in the coming years. Vixio thinks sportsbook revenue will grow from about $10.1 billion in 2023 to $24.2 billion by 2028 — a nearly 140% increase.

The market could grow even larger should additional states opt to enter the legal sports betting space.

We forecast the US online sports betting market to be worth $24.2 billion to $27.8 billion in total annual gross revenue by 2028, depending on whether legislative trends align with our base-case or more optimistic bull-case scenarios,” the Vixio report read.

The US sports betting boom came after the Supreme Court in May 2018 struck down PASPA — the Professional and Amateur Sports Protection Act — a federal law that had limited single-game wagering to Nevada. When PASPA was enacted in 1992, Nevada had legal sports betting in place. Congress provided PASPA immunity to the Silver State.

Key States Remain

Thirty-eight states and Washington, DC currently have legal sportsbooks. Voters in Missouri will decide whether to become the 39th state to authorize sports wagering through a ballot referendum during the November 2024 election.

Of the present 39 sports betting jurisdictions, 31, including DC, allow mobile wagering. The Vixio forecast assumes there will be 33 online sports betting markets by 2028.

Recent polling suggests that the Missouri sports betting referendum will pass. Emerson College Polling reported this month that 52% of likely voters will back the ballot measure, while just 25% said they would not. About 23% said they were unsure.

Vixio didn’t opine as to which state might be next after Missouri to expand the online sports betting market to 33 jurisdictions by 2028.

Lawmakers in Georgia, Minnesota, and South Carolina have mulled sports betting laws in recent legislative sessions. While any of those three states would help grow sports betting revenue, a bigger prize would be if online sportsbooks came to California and/or Texas, two states that remain on the legal sports gambling sidelines.

California and Texas are the two most populated states in the country with a combined population of nearly 70 million people.

iGaming Growth

iGaming, or online slots and table games, is legal in only seven states — Connecticut, Delaware, Michigan, New Jersey, Pennsylvania, Rhode Island, and West Virginia. Vixio doesn’t think there’s much appetite in state capitals to grow that market to eight by 2028, but forecasts ongoing online casino gambling revenue gains.

Vixio is forecasting the iGaming market to reach $18.2 billion to $20.9 billion in gross gaming revenue by 2028. The legal iGaming industry in 2023 won almost $7 billion from remote players.

If Vixio’s sports betting and iGaming projections are realized, the legal online gambling market in the US would be valued at $38.2 billion to $41.8 billion in the next four years.